Return Inwards Debit or Credit

Amount is the money he want to credit or debit. Banton September 13 Sales SJ01 78550 September 24 Return Inwards RI01 16800 September 29 Discount Allowed CB01 6175 29 Cash CB01 55575 78550 78550 Page 03 Page 02 20.

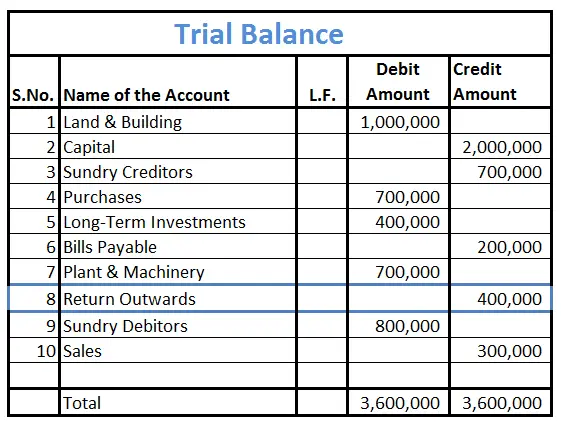

How Is Return Outwards Treated In Trial Balance Accounting Capital

The sale of an old car is recorded in the Sales Register 17.

. Global res for i in range5. Cheque returned charges AED 105 Cheque Return with the code represent after 3 working days AED 105 Total AED 210. The balance goes straight onto one of your existing debit or credit cards.

It contains a list of all the general ledger accounts. To Sales return Ac. Copy and paste this code into your website.

Recording the transaction in the subsidiary books is the first step in the accounting. A sales return sometimes called a returns inwards is recorded in the accounting records as follows. Sales return account is closed by transfer of balance to sales account.

It is an. Journal Entry for a Sales Return. Sales returns Return inwards Total sales returns from the Return Inwards Day book Sales returns journal.

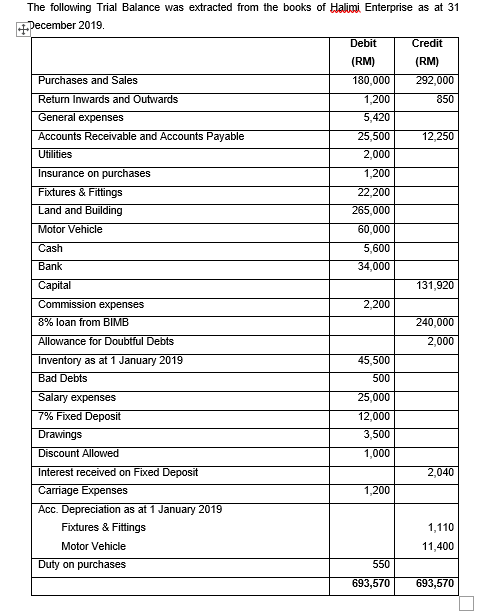

Here is how you can fix it. Taxpayers who have deducted tax at source must provide the following details in their form. The term trial balance refers to the total of all the general ledger balancesIt is a statement prepared at a certain period to check the arithmetic accuracy of the accounts ie whether they are mathematically correct and balanced.

Res 0 def multiply_five_timesn. Kidman September 20 Sales SJ01 104400 September 30 Return Inwards RI01 9600 September 30 Balance cd 94800 104400 104400 October 1 Balance bd 94800 B. Today a debit card works by instantly verifying the balance of your bank account and debiting from it.

A ledger is the actual account head to identify your transactions and are used in all accounting vouchers. Trading account Profit and Loss account and Balance Sheet are. After which a taxpayer will be able to file outwards and inwards return as well as cumulative monthly returns.

A credit note is sent to inform about the credit. Download the app for iPhone or Android. If you get a loan to buy a car the bank credits your current account and you then write a cheque use a credit or debit card or initiate a bank transfer to the car dealer to buy the car.

Without a ledger you cannot record any transaction. Credit or debit cards were not yet widely used. From the bank column on the debit side of the Cash Book.

Thus matching of the trial balance is a Thing of Past and the traditional need for someone to depend on trial. 5 Instant Discount up to INR 250 on HSBC Cashback Card Credit Card Transactions. Credit Note is the basis for making entry in the Purchase Returns Book 18.

1500 Instant Discount on Standard Chartered Credit Card EMI transactions. Total of the Discount column on the debit side of the Cash book. Return outwards are goods returned by a customer to the seller.

Credit and debit note details. It implies that if the sum of all debits equals the sum of all credits it is presumed that the posting to the ledger in terms of debit and credit amounts is accurate. Related Topic Accounts Payable with Journal Entries Credit Note.

For example purchase payments sales receipts and others accounts heads are ledger accounts. It is a sales return and on. Read more becomes a debit Debit.

Profit and Loss Account Format. As per the mandate from Central Bank of the UAE cheque books issued during the first 6 months of opening the account could be limited to 10 leaves depending on the Individuals rating with the credit bureau AECB. The trial balance is a tool for verifying the correctness of debit and credit amounts.

Inward returns reduce the total accounts receivable for the business. 1500 Instant Discount on Kotak Bank Credit Card and Debit Card EMI transactions. Res n i return res.

Debit The goods are returned and the asset of inventory increases. From the cash column on the debit side of the Cash Book. Enter your details theyll send you a Curve MasterCard - they send to most European addresses including the UK.

Get 75 up to Rs. Accounting software like TallyPrime is designed to ensure that debit and credit always match at the time of recording the transaction itself. They are goods which were once sold to external third parties however because of being unsatisfactory they were returned by the customerThey are also called Sales Returns.

When a Seller receives goods returned from the buyer he prepares and sends a credit note as an intimation to the buyer showing that the money for the related goods is being returned in the form of a credit note. Debit Note is an instrument or document which is given by the buyer or purchaser of the goods and services to the seller. Link your existing credit debit cards to the app.

They are goods that were once purchased from external parties however because of being unsatisfactory they were returned back to them they are also called Purchase returns. Outward returns reduce the total accounts payable for a business. Losses Depreciation Return inwards Profit and loss Ac Dr Bad debts etc.

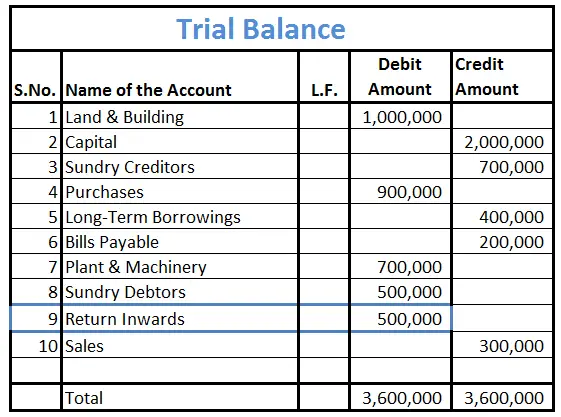

A credit note is a document sent by a seller to the buyer as a notification to acknowledge that the goods have been registered as return inwards and a credit has been. Return inwards are goods returned to a business by its customers. Minimum purchase value INR 1000.

The entries about the Freight inwards are posted on the debit side of the trading account whereas the entries about the carriage outwards are posted on the credit side of an income statement Income Statement The income statement is one of the companys financial reports that summarizes all of the companys revenues and. The profit and loss account starts with gross profit at the credit side and if there is a gross loss it is shown on the debit side. To fix this issue shift the return function inwards.

Sales Return Bookkeeping Entries Explained. And you can get a Curve card for free. The Sales Register is a part of the ledge 19.

Basic principles of accounting that for every debit there will be an equal credit. The customer account gets a credit entry and the sales return Sales Return The term sales return is used in payroll journal entry to account for customer returns in the books of account or to account for when a customer returns goods sold owing to defect goods sold or misfit in the customers requirement etc. The debit note is issued by the purchaser against the seller to inform him that the goods or services have been returned and now the seller is debited against the purchaser to the sum of goods and supplies return.

It is a sales return and on the other it. Credit Note When a customer returns goods purchased on credit heshe also expects some form of confirmation from the seller along with the cancellation of related dues. Total of Return Inward Register is credited to Return Inwards Account 16.

Tax credit that has been received reverted and distributed under CGST SGST and IGST. Purchases account closed by transferring to debit side of trading and P. And after that bank-wise remittance messages are forwarded to the destination bank through their pooling centre NEFT Service Centre.

Get 75 up to Rs. The NEFT clearing centre sorts fund transfer destination-wise and prepare to account entries to receive funds from the originating banks debit and give credit the funds to the designated bank. Sample Format of a Debit Note.

You can alter any information of the ledger master with the except for the closing balance under the group s tock-in-hand.

What Are Return Inwards Example Journal Entry Accounting Capital

The Following Trial Balance Was Extracted From The Chegg Com

How Is Return Inwards Treated In Trial Balance Accounting Capital

How Is Return Inwards Treated In Trial Balance Accounting Capital

0 Response to "Return Inwards Debit or Credit"

Post a Comment